Cold chain logistics is on fire.

In the last year, we have seen a string of deals in temperature-controlled supply chain services. Buyers and investors have funded aggressive initiatives in this market, in the US and around the world.

On the technology side, Cold Chain Technologies sold to Aurora Capital. The deal marked a milestone for CCT, a leader in temperature-sensitive packaging solutions.

On the warehousing side, we have witnessed a massive consolidation of facilities. The two largest players, Lineage Logistics and Americold, have gobbled up key competitors in a bid to dominate the sector. Recent deals include

- In Asia and Latin America, the Lineage Logistics acquisition of Emergent Cold from Elliott for $900 million

- In Canada, the Americold acquisition of Nova Cold Logistics from Brookfield for $253 million

- In the United States, the Lineage purchase of Preferred Freezer for over $1 billion

In just 11 years, Lineage has skyrocketed to become the largest company in its field. Today, Lineage and its competitor Americold together control 63% of the market for cold-storage warehousing, according to the International Association of Refrigerated Warehouses.

Why is there such a sudden spike of investor interest in cold chain logistics?

I believe there are four key reasons.

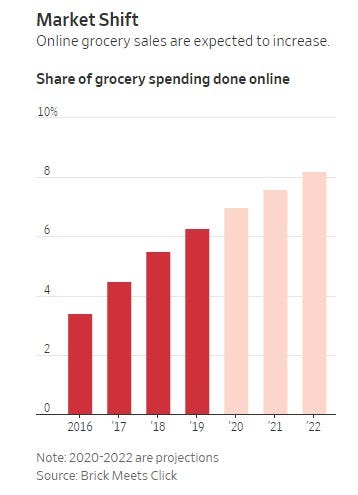

First, customers are seeking same-day delivery of fresh food. Online grocery sales are up 15% this year. The share of grocery spending online has doubled in 3 years, to 6%. This demand is fueling consolidation in the food delivery market. Germany’s DeliveryHero just bought South Korea’s Woowa for $4 billion. In turn, same-day produce requires an increase in cold-storage facilities.

Second, the boom in same-day logistics is driving an expansion in small, urban warehousing locations. Walmart, Albertsons, Safeway, and others are investing in these micro-fulfillment centers to produce. These 10,000–20,000 square foot warehouses can be built in as little as 3 months. They enable retailers to meet customer demand more quickly.

Third, the same forces that are fueling consolidation in truck brokerage and freight forwarding apply to cold-chain warehousing too. XPO has grown from $75 million to $14 billion in enterprise value in just over 8 years. A buying binge of 17 companies drove its growth. Cold storage acquirers can also benefit from economies of scale. They can cut costs by eliminating overlapping overhead. They can pool technology investment across a broader base. And they can generate cross-selling into new markets. Buyers like Lineage, Agro, Emergent and Americold have all achieved these benefits.

Fourth, investors like the recession resilience of the cold chain. We are entering the 10th year of economic expansion, setting a record not reached since 1853. Investors are nervous about the likelihood of an economic contraction. Food logistics offers a hedge. In a downturn, food is thought to be recession-resistant. As Americold CEO Fred Boehler said, “Whether there are a bad harvest or cattle shortages, we as consumers, are still going to eat.”

As a result, the cold storage business is on fire. In the private markets, M&A and investment continue to surge. In the public markets, bellwether Americold’s stock has spiked 46% this year. The company now trades at record levels of 27x EBITDA. This market value growth comes despite relatively conservative EBITDA growth from $282 million to $297 million, according to Capital IQ.

Is the cold chain market overheating? Some think so. On the other hand, if we are witnessing a secular increase in growth in online grocery sales, then perhaps the outlook will remain bright.

Investors like Cambridge Capital, who tend to be growth-oriented, are considering cold storage logistics companies because the long-term growth opportunity remains compelling. As consumers continue to prioritize fresh food, organic perishables, and same-day delivery, it is likely that this supply chain sector will continue to serve up an opportunity.