On November 3, the American people will vote. We may not know the actual election results immediately, due to unprecedented volumes of vote-by-mail. However, the polling currently suggests a Democratic sweep of the White House, Congress, and Senate. Meanwhile, Wall Street increasingly expects a Blue Wave. What will be the ripple effects for taxes, business owners and logistics?

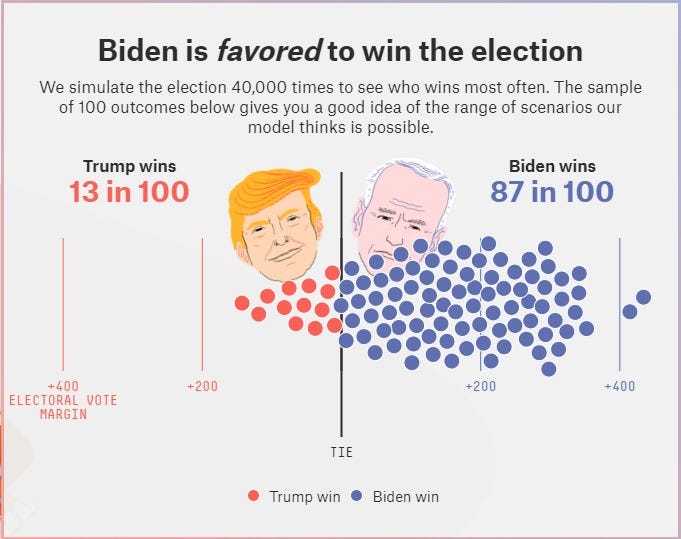

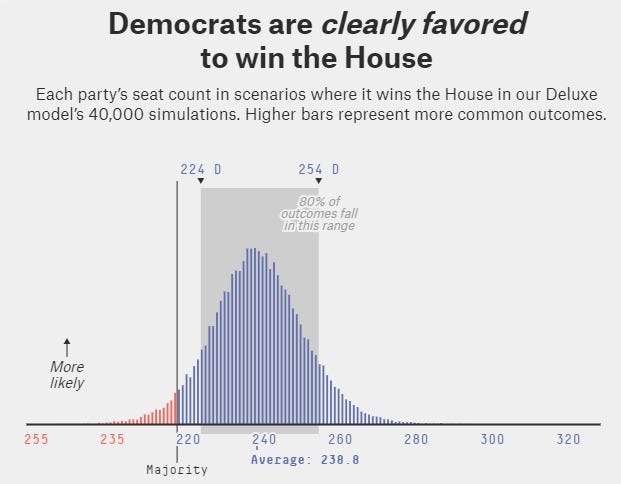

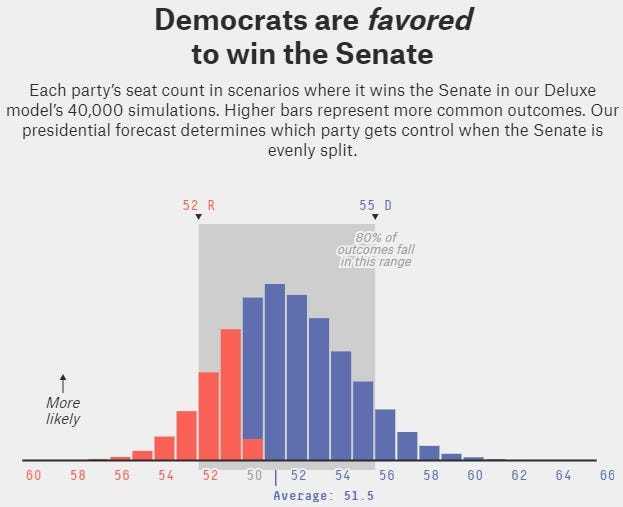

As FiveThirtyEight polling analysis reflects, the data suggests a decisive Democratic victory in all three sets of races. Let’s take a closer look at the forecasts and their implications for business owners.

The Election Forecasts

First, in the Presidential election, Biden is currently favored by an 87/13 margin.

Second, in the Congressional elections, Democrats are even more likely to maintain their advantage.

Third, in the Senate, Democrats are currently predicted to win by a 52/48 margin.

What the Blue Wave Means for Owners: Higher Taxes

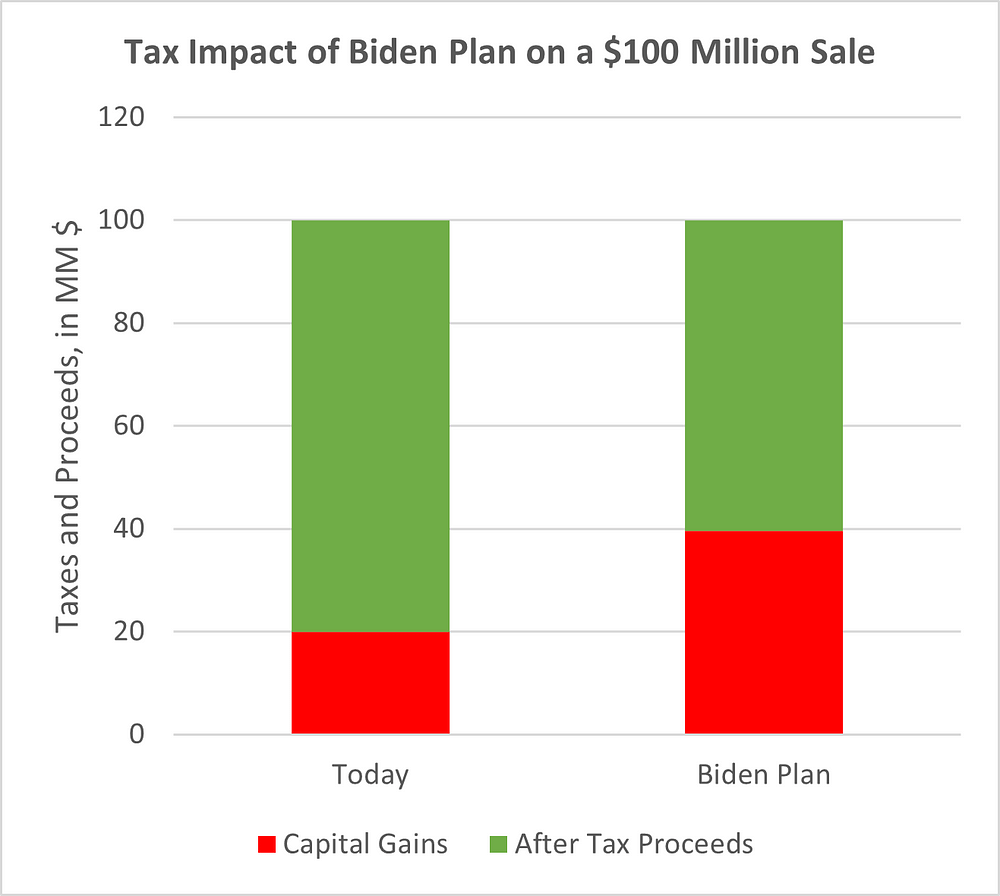

For starters, the Biden tax plan is likely to become a reality. This tax plan includes several dimensions:

- An increase in top federal tax rates, from 37% to 39.6%

- An increase in top capital gains rates, from 20% to 39.6%

- An increase in corporate tax rates, from 21% to 28%

- A new 12.4% “high earner” payroll tax on all income above $400,000

- A decrease in the estate tax exemption, from $22.4 million for married couples down to an undetermined level (some have proposed as low as $1 million)

See here for a detailed assessment of the Biden tax plan.

If you have been thinking about the possibility of selling all or part of your business, this math makes a big difference. An owner of a $100 million business could see his/her taxes on a sale double from $20 million to $39.6 million. In addition, with a lower estate tax exemption, if that owner wanted to pass the business on to his/her children, combined estate and capital gain taxes could exceed 60%.

Meanwhile, an owner that defers a sale is likely to incur higher operating costs. Under the Biden plan, taxes will increase on multiple fronts, including corporate tax rates, individual tax rates, and “high earner” payroll tax rates. In the hypothetical example of a $100 million business, if the company were an LLC generating $10 million of profit, the tax on that profit could increase from $2 million to $3.96 million.

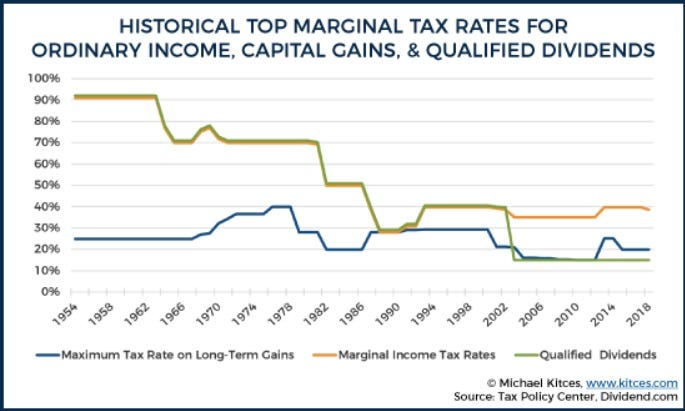

Furthermore, for those who question whether the tax rates are likely to change, a look at history is instructive. Over the last seven decades, ordinary income and dividend tax rates have ranged from as high as 90% to as low as 15%. Similarly, capital gains have ranged from 40% to 15%. If past is prologue, in the event of a Blue Wave, Congress can, and will, implement higher taxes.

For this reason, many owners are exploring deal options. But how much time do you have? It is conceivable that the 117th United States Congress could pass a tax bill retroactive to January 1, 2020, in which case you would have very little time to lock in current tax rates. On the other hand, it is also possible that Congress could pass a bill in March (or later) and issue tax increases effective on that day.

What Can You Do?

Smart owners have several choices. One possibility is to sell. In the current climate, strategic buyers have become aggressive. For instance, NFI acquired CAI Logistics, in a deal that closed in less than 60 days. A second option is to pursue a recapitalization with a private equity investor. Last week, HIG invested in Capstone Logistics. A third option is to go public or merge with a SPAC. Just this month, Momentus went public via a SPAC. In transportation and logistics, for high-quality companies, all of these options are feasible.

Here at Cambridge Capital, we are in a position to be responsive to logistics and supply chain technology owners who are looking for advice or are ready to act. In fact, we have recently closed on three supply chain investments. We are poised to move quickly to provide capital and support for outstanding companies that fit our strategy and criteria. If you are interested in exploring ideas, please feel free to contact us.

Benjamin Gordon is Cambridge Capital CEO. Cambridge invests in high-quality companies in all areas of transportation, logistics, and supply chain technology. Cambridge draws on a long history of backing outstanding founders and helping their companies grow. For more information about Cambridge, please visit their website and follow them on LinkedIn and Twitter.