Next week I’ll be speaking at Panama Invest 2017. A primary topic of discussion: how will supply chain disruption impact Panama?

On the one hand, Panama has one of the most valuable supply chain assets in the world. Completed in 1914, the Panama Canal became the strategic link between the Atlantic and Pacific Oceans. A 400-year-old idea (dating back to Balboa’s discovery in 1513) became a possibility after close to 100 years of work on the part of Spain and France. It became a reality after 10 years of construction by the US, under the leadership of President Roosevelt. And it became a strategic asset during World War II, when it helped the US to replenish its Pacific fleet of aircraft carriers.

Today, the Panama Canal represents not just a technological marvel, but also a commercial breakthrough. A 48-mile man-made waterway, it saves nearly 8,000 miles on a sea trip from New York to San Francisco. It represents the fulcrum of East-West commerce. And it serves as Panama’s crown jewel, generating $2 billion in annual fees, and fueling Panama’s growth rate of 7% since the beginning of this century (nearly triple that of the US).

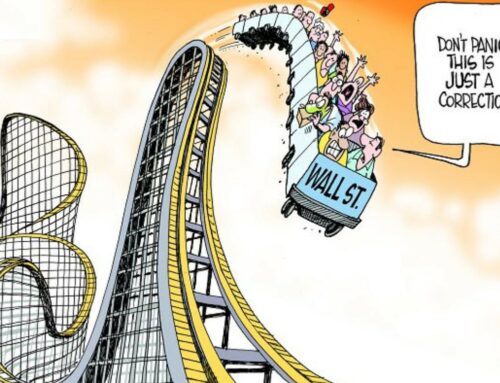

On the other hand, nobody is immune from disruption. The Panama Canal may seem like a monopoly in global shipping, collecting a toll from all who pass through. But it faces threats as well.

One threat is the rise in protectionism. What happens if a trade war erupts? Or if increased tariffs and trade barriers lead to a decline in globalization?

A second corresponding threat is the growth of nearshoring. Will US companies reduce their manufacturing in Asia, and shift to the US, Canada, and Mexico? If so, will we see a reduction in global shipping?

A third risk is the emergence of three-dimensional printing. Will 3-D printers cut the need to manufacture and ship goods from far away?

A fourth risk is the rise of last-mile logistics solutions, fueled by new technologies. As drones adapt, will we see low-cost shipping solutions for the last mile? Could a combination of 3-D printers and last-mile logistics technologies radically reshift global supply chains?

Smart transportation and logistics companies are investing in these and other disruptive trends. See this article for one perspective on how UPS and others are expanding their corporate venture capital investments, in order to protect against the risks and to benefit from the opportunities.

If you were in charge of Panama today, what would you do to invest in the future and protect yourself from these disruption risks?

Perhaps you would look at Saudi Arabia. In the face of finite oil and gas resources, the Saudi regime has begun to accelerate its investments in technologies. In May 2017, in partnership with Softbank, the Saudi Arabian Public Investment Fund (PIF) launched a $100 billion fund. Its aim? To invest in new technologies that will diversify the Saudi economy, gain access to powerful new technology businesses, and provide the next chapter of long-term growth for the economy.

So what should Panama do? I would welcome your ideas! Please feel free to contact me on my Benjamin Gordon LinkedIn page, or post your comments.