Today, GreenScreens.ai announced the closing of an investment to accelerate their growth in predictive pricing and advanced analytics. The round was led by Tiger Global, with participation from Cambridge Capital, Flyer One Ventures, Navigate Ventures, Jones Capital, Red Door Capital, Overton Venture Capital, Operator Stack Fund, and Refashiond Ventures.

More than capital, this investment represents a vote of confidence in GreenScreens as a vital part of the supply chain technology ecosystem.

What Does GreenScreens.ai Do?

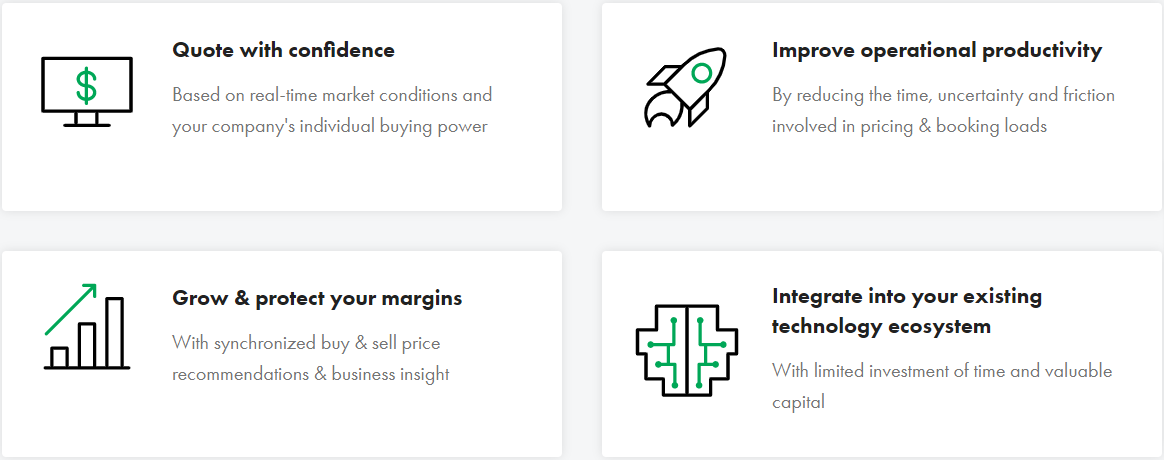

In a world with increasing supply chain volatility, it is more important than ever to have reliable data and analytics. GreenScreens has developed the best solution I have seen for predictive pricing. Its AI-based tools give logistics companies the ability to generate real-time pricing and advanced analytics. As a result, brokers and their shippers are saving a lot of money on freight cost, while also gaining accuracy and reducing errors. And carriers benefit in the same way.

Why Does It Matter?

Volatility is a tax on the entire supply chain industry. There are times when shippers overpay for freight, when carriers undercharge for capacity, and when brokers lose money on transactions. GreenScreens.ai is bringing innovation to truck brokerage. Its AI gives tools to logistics companies to make better, more profitable decisions. They are unique in providing powerful, bottom-up solutions for customers, based on their own freight data. These tools enable logistics companies to price more accurately. And as a result, the entire industry stands to gain.

What Will Happen to Logistics in the Long Run?

Think of the financial markets in 1970. It was a year before Charles Schwab was founded. Trading commissions averaged close to $1 per share. Options markets were inefficient. And everyone paid a price. So what happened?

Schwab invested in technology, such as the BETA mainframe system. As a result, they began to automate transactions and recordkeeping. Meanwhile, deregulation allowed companies to set different prices for transactions. And low-cost brokers like Schwab drove commissions down, from close to $1 per share to what today is, in some cases, free. Meanwhile, option trading became much more accurate, powered by Black-Scholes models, sophisticated hedge funds, and powerful technology.

As a result, customers won. Commissions came down. People developed strategies for hedging risk. And the markets became accessible to a much broader marketplace.

At the time, people thought new technology would “cut out the middleman.” But is that what happened? No. Some brokers were commoditized. But many others became very successful, by using technology and services to provide a better experience for their customers. Today, brokerage firms like Schwab are thriving. Schwab has accumulated $8 trillion in client assets. Fidelity has reached $1.2 trillion in assets, and has expanded into mutual funds, brokerage, benefits outsourcing, donor-advised funds, and even cryptocurrency. And new models like Webull have emerged.

The GreenScreens.ai Outlook

In sum, GreenScreens.ai can help brokers boost their margins, while also benefiting shippers, carriers, and the entire supply chain. I’m very excited about what they are building.

–Benjamin Gordon, Cambridge Capital